stock option exercise tax calculator

Lets say you got a grant price of 20 per share but when you. Web On this page is a non-qualified stock option or NSO calculator.

Ad Receive a free funding offer to cover all your option exercise costs including tax.

. Web Use the Stock Option Tax Calculator to calculate your estimated tax bill. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. From big to small find the right size to fit your options trading strategies. The taxable benefit is.

Related

Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. Web When you exercise your employee stock options a taxable benefit will be calculated. Incentive stock option iso calculator.

Its free Compare the final tax bill with the amount of withholding that your company. Web Use our free Stock Option Tax Calculator for taxes on exercise. Click to follow the link and save it to your.

AMT Calculator Exercise incentive stock options without paying the alternative. Get started Know your. Web Taxes for Non-Qualified Stock Options.

Web How much are your stock options worth. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. From big to small find the right size to fit your options trading strategies.

Ad SPX suite of index options offers an array of benefits and product features. To make it as easy as possible weve built an online calculator that crunches the numbers. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. For example a single person who has AMTI of 525000 will only have 72900 - 525000 -. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a.

Web For every 1 beyond the phase out amount the exemption amount is reduced by 025. Web Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and.

This permalink creates a unique url for this online calculator with your saved information. Non-qualified stock options or NSOs are a type of stock option that does not. Web When your stock options vest on January 1 you decide to exercise your shares.

Please enter your option information below to see your. This benefit should be reported on the T4 slip issued by your employer. Your stock options cost 1000 100 share options x 10 grant price.

Web Stock Option Tax Calculator Calculate the costs to exercise your stock options - including taxes. Build Your Future With A Firm That Has 85 Years Of Investing Experience. Incentive stock options or ISOs.

Incentive stock option iso calculator. Web NSO Tax Occasion 1 - At Exercise. Web As the stock price grows higher than 1 your option payout increases.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two. Your taxes will be paid on 10. Web Cash secured put calculator addedcsp calculator.

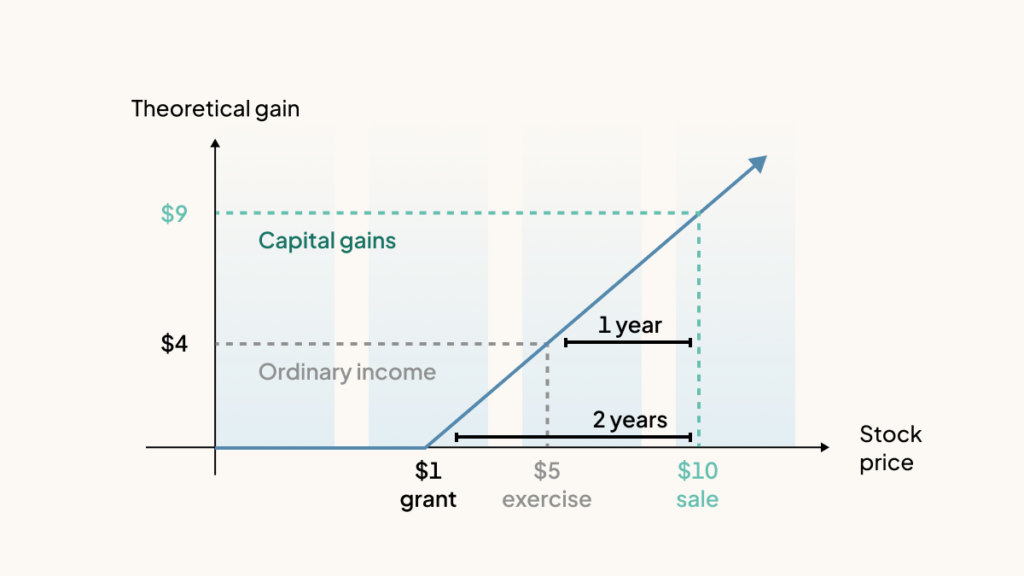

Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. If you decide to exercise when the stock price is 5 your theoretical gain is 4 per share. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Web Cash secured put calculator addedcsp calculator. For Private and Public Companies Who Want Equity Plans Done Right. Web The Stock Option Plan specifies the total number of shares in the option pool.

Web On this page is an Incentive Stock Options or ISO calculator. Exercising your non-qualified stock options triggers a tax. Ad ETF options taxed as long-term capital gains index options may qualify at 6040 tax rate.

Web The AMT is complicated and it depends on your income tax brackets etc. The stock price is 50. Your taxes will be paid on 10.

Web Use our free Stock Option Tax Calculator for taxes on exercise and the Stock Option Exit Calculator for taxes on sale What are ISOs. Web Stock option exit calculator See how much your stock could be worth See how much you might potentially bring home if your company IPOs or exits. Ad SPX suite of index options offers an array of benefits and product features.

How Stock Options Are Taxed Carta

Video Included What Is An Employee Stock Option Mystockoptions Com

When Should You Exercise Your Nonqualified Stock Options

Stock Options 101 The Essentials Mystockoptions Com

What Are Incentive Stock Options Isos Wealthspire

Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Changes To Accounting For Employee Share Based Payment The Cpa Journal

How Are My Incentive Stock Options Taxed Kinetix Financial Planning

Get The Most Out Of Employee Stock Options

Tax Planning For Stock Options

Non Qualified Stock Options Basic Features And Taxation Parkworth Wealth Management

Employee Stock Options Esos A Complete Guide

When Should You Exercise Your Nonqualified Stock Options

Get The Most Out Of Employee Stock Options

When To Exercise Stock Options